Discover the ultimate credit card experience with American Express. Read our detailed review to explore the benefits, rewards, and features offered by American Express credit cards.

Are you looking for the best credit card experience? Take a look at American Express. With a rich 160-year history, American Express has earned a reputation as a reliable and prestigious financial institution. In this comprehensive review, we will look at the features, benefits, and perks that set Company apart from the competition. American Express provides cardholders with a world-class experience, from their wide range of credit card options tailored to different lifestyles and preferences to their exceptional customer service and global acceptance.

The company has a card to suit your needs, whether you’re a frequent traveler, a foodie looking for dining rewards, or simply looking for the best cashback options. Join us as we investigate the unrivaled rewards program, exclusive access to events, and added peace of mind that comes with an American Express card. Discover why so many people and businesses rely on American Express to help them succeed financially.

Benefits of using American Express credit cards

Generous Rewards Programs

American Express cards come with lucrative rewards programs that allow cardholders to earn points or cashback on their purchases. These rewards can be redeemed for a variety of options, including travel, merchandise, gift cards, and statement credits. With American Express®, your everyday spending can turn into exciting rewards and experiences.

Travel Perks and Insurance

For travel enthusiasts, Company offers a range of cards that provide exclusive travel perks. These include access to airport lounges, complimentary hotel upgrades, airline fee credits, and travel insurance coverage. Whether you’re a frequent flyer or an occasional traveler, American Express has a card that will elevate your travel experience.

Exceptional Customer Service

One of the standout features of the Company is its commitment to providing top-notch customer service. Cardholders have access to 24/7 customer support, ensuring that any concerns or issues are promptly addressed. Whether you have a question about your account, need assistance with a transaction, or require help with a lost or stolen card, Company is there to assist you every step of the way.

Global Acceptance

American Express cards are widely accepted around the world, making them a convenient choice for international travelers. Whether you’re exploring exotic destinations or simply shopping online from the comfort of your home, you can trust that your American Express card will be accepted by merchants worldwide.

Purchase Protection and Extended Warranty

When you use an American Express card for your purchases, you can enjoy added protection. The company offers purchase protection, which safeguards your eligible purchases against accidental damage or theft for a specified period after the purchase. Additionally, many American Express cards provide an extended warranty, extending the manufacturer’s warranty on eligible items purchased with the card.

American Express credit card options

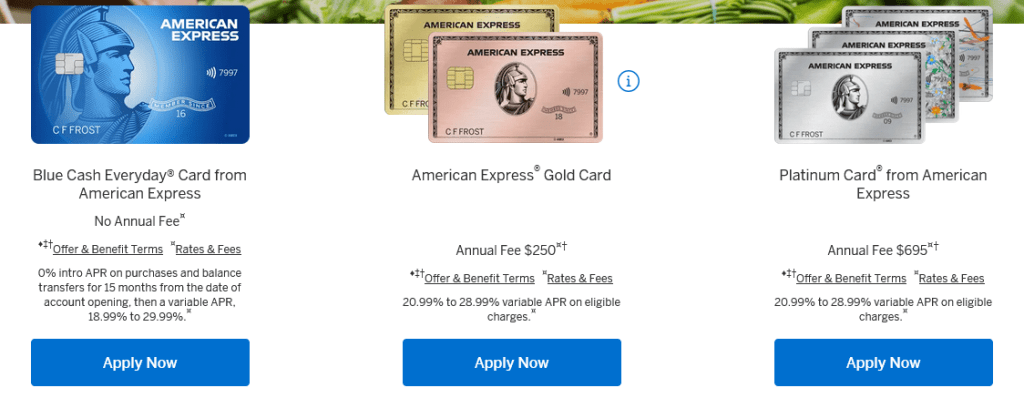

The company provides a diverse range of credit cards, ensuring that there is a card to suit every lifestyle and spending preference. Let’s look at some of the most popular card types:

American Express Platinum Card: This premium card is tailored for frequent travelers, offering a host of travel-related benefits. Cardholders enjoy airport lounge access, elite status with hotel partners, airline fee credits, and complimentary hotel stays. The Platinum Card also provides extensive travel insurance coverage, making it an ideal choice for those who prioritize luxury and convenience.

American Express Gold Card: Designed for foodies and dining enthusiasts, the Gold Card offers generous rewards for dining and grocery purchases. Cardholders earn points that can be redeemed for travel, gift cards, or statement credits. Additionally, the Gold Card provides travel insurance, shopping protections, and access to exclusive events and experiences.

American Express Cash Magnet Card: If you prefer simplicity and cashback rewards, the Cash Magnet Card is an excellent choice. Cardholders earn unlimited 1.5% cashback on all purchases, with no annual fee. The card also offers a 0% introductory APR on balance transfers for the first 15 months, making it a great option for consolidating debt or managing expenses.

These are just a few examples of the diverse range of American Express credit cards available. Whether you’re a frequent traveler, a foodie, or looking for simplicity and cashback rewards, Company has a card to match your lifestyle and financial goals.

American Express rewards program

The robust rewards program offered by American Express credit cards is one of their most notable features. Cardholders can earn points, miles, or cashback on purchases, allowing them to get the most out of their money. The rewards program varies depending on the card, but in general, Company provides generous rewards across a variety of spending categories.

The American Express Platinum Card, for example, rewards cardholders with Membership Rewards points. These points can be redeemed for travel purchases, transferred to airline and hotel partners, or applied to account balances. In contrast, the Gold Card offers points that can be redeemed for travel, gift cards, or statement credits, with a focus on dining and grocery purchases.

The company frequently offers limited-time promotions and bonus point opportunities in addition to earning rewards on everyday spending. These promotions can be extremely valuable, allowing cardholders to earn even more rewards on specific purchases or during specific time periods.

Another distinguishing feature of the American Express rewards program is the ability to transfer points to a number of airline and hotel loyalty programs. Cardholders can maximize the value of their points by redeeming them for high-value travel experiences thanks to this flexibility.

American Express customer service

The company has a reputation for providing outstanding customer service. Their dedicated support team is available 24 hours a day, 7 days a week to assist with any questions or concerns. Whether you need assistance with a transaction, have questions about your rewards program, or need help making travel arrangements, American Express customer service representatives are trained to provide prompt and personalized assistance.

Cardholders can contact Company customer service via phone, email, or live chat. The support team is known for their professionalism, knowledge, and willingness to go above and beyond to ensure customer satisfaction. This dedication to providing excellent customer service distinguishes American Express from other credit card providers.

In addition to general customer service, Company provides specialized assistance for travel-related issues. If you have any issues during your trip, such as lost luggage or flight cancellations, American Express can help you resolve the situation. This added peace of mind is invaluable, especially for frequent travelers who rely on their credit cards for travel-related expenses.

American Express acceptance and global reach

The widespread acceptance of American Express credit cards, both domestically and internationally, is one of their primary benefits. The company is accepted in millions of locations around the world, including major retailers, restaurants, hotels, and online retailers. This global acceptance ensures that cardholders can use their American Express card without fear of limitations or restrictions wherever they go.

Furthermore, American Express has formed alliances with numerous airlines, hotels, and merchants to provide cardholders with exclusive deals and benefits. From discounted hotel stays to priority boarding on flights, these partnerships enhance and add value to the overall cardholder experience.

Additionally, American Express provides a Global Assist hotline for cardholders traveling outside of their home country. Whether you need assistance with a medical emergency, legal referrals, or the replacement of a lost passport, the Global Assist hotline is available 24/7 to provide support and guidance. Because of its global reach and support, American Express is an excellent choice for frequent travelers and people who value convenience and peace of mind.

American Express fees and charges

While American Express credit cards offer numerous benefits and rewards, it’s important to be aware of the associated fees and charges. The company charges an annual fee for most of its premium cards, such as the Platinum Card and the Gold Card. The annual fee varies depending on the specific card and can range from $95 to $550 or more. However, the benefits and rewards offered by these cards often outweigh the annual fee, making them a worthwhile investment for many cardholders.

Additionally, the Company may charge foreign transaction fees for purchases made in currencies other than the US dollar. These fees typically range from 2% to 3% of the transaction amount. If you frequently travel internationally or make purchases in foreign currencies, it may be worth considering a card with no foreign transaction fees to avoid these additional charges.

It’s also worth noting that American Express has a number of credit cards with no annual fee, including the Cash Magnet Card and some of their basic reward cards. These no-fee options are ideal for people who prefer simplicity and want to avoid annual fees entirely.

American Express security features

When it comes to credit cards, security is a top priority, and Company takes it very seriously. Their cards have advanced security features that protect cardholders from fraud and unauthorized transactions. The ability to set up alerts for suspicious activity is one of the notable security features. Cardholders can opt to receive email or text message notifications for specific types of transactions, such as large purchases or transactions made in foreign countries. This enables cardholders to detect and address potential fraudulent activity as soon as it occurs.

Furthermore, the Company provides a fraud protection guarantee, ensuring that cardholders are not held liable for any unauthorized charges. If a cardholder notices any unauthorized transactions, they can report them to American Express, and the charges will be investigated and removed if found to be fraudulent.

The company also offers the option to add an extra layer of security with their “SafeKey” feature. SafeKey is a secure online payment service that adds an extra step of verification when making online purchases, reducing the risk of unauthorized use of your card details.

American Express mobile app and online account management

The company provides a user-friendly mobile app and online account management system to make managing your American Express credit card easier and more convenient. Cardholders can use the mobile app to view account balances, track transactions, make payments, and redeem rewards from the comfort of their smartphone or tablet.

The mobile app also sends real-time transaction notifications, allowing cardholders to stay informed and track their spending. Furthermore, the app provides personalized recommendations based on spending patterns, assisting cardholders in making sound financial decisions.

The company offers a comprehensive online account management system for those who prefer to manage their accounts through a web browser. Cardholders can access their accounts by logging in to view statements, set up automatic payments, dispute charges, and access other account features. The online account management system is safe and simple to use, ensuring cardholders have a positive experience.

Comparison with other credit card providers

While Company provides an excellent credit card experience, it is important to compare its offerings with those of other credit card providers to ensure you select the best option for your needs. The acceptance rate of American Express differs from that of some other providers. While Company is widely accepted, some merchants may refuse to accept American Express cards. As a result, it’s critical to consider a credit card provider’s acceptance rate in the areas you frequent the most.

Additionally, other credit card issuers might provide various rewards programs and advantages that better fit your spending preferences and way of life. To determine which card will offer the best value for you, it’s critical to compare the rewards rates, redemption options, and any additional benefits provided by various providers.

Last but not least, fees and charges differ between credit card companies. Depending on your spending patterns and travel plans, some providers might offer lower annual fees or no foreign transaction fees, which can be beneficial. To make an informed choice, it’s crucial to carefully examine the fees and charges applied by various credit card issuers.

Gousto Review: Exploring the Ultimate Meal Kit Experience 2023

Conclusion

American Express offers the ultimate credit card experience with its wide range of card options, exceptional customer service, and global acceptance. Whether you’re a frequent traveler, a foodie looking for dining rewards, or seeking simplicity and cashback options, American Express has a card to suit your needs. The robust rewards program, exclusive access to events, and added peace of mind provided by American Express makes it a trusted choice for individuals and businesses alike.

With their commitment to customer satisfaction, advanced security features, user-friendly mobile app, and online account management system, American Express elevates the credit card experience to new heights. While it’s important to compare American Express with other credit card providers to ensure the best fit for your specific needs, American Express undoubtedly offers a world-class experience that is unparalleled in the financial industry. Apply for an American Express card today and discover the countless benefits and rewards that await you on your financial journey.